The Federal Solar Tax Credit, formally known as the Residential Clean Energy Tax Credit, is a fiscal incentive provided by the U.S. government to stimulate investment in solar power systems. This guide provides a detailed overview of the solar tax credit, its benefits, eligibility criteria, and how to claim it.

Introduction

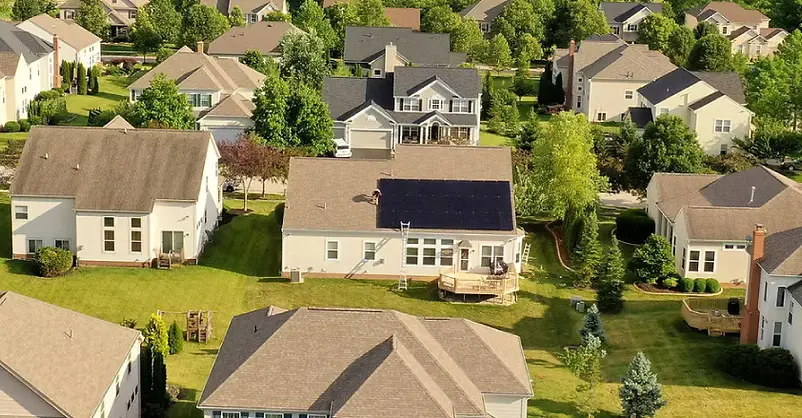

The U.S. government encourages homeowners to switch to solar energy by offering a federal solar tax credit. This financial incentive can offset up to 30% of the cost of installing a solar power system, making renewable energy more affordable for the average homeowner.

What is the Federal Solar Tax Credit

The Federal Solar Tax Credit is an investment tax credit (ITC) designed to spur investment in solar energy. Under the Inflation Reduction Act signed by President Joe Biden in 2022, this credit has been extended until 2034.

Note: The credit does not cover structural work solely done to support the solar panels.

The available tax credit can vary based on the total expenditure on the project and its completion date.

However, the solar tax credit is nonrefundable, meaning it can only reduce your tax liability to zero, not beyond. Any unused portion can be carried forward to the next tax year.

Benefits of Solar Tax Credit

The solar tax credit offers significant savings on income taxes. According to the U.S. Department of Energy, the tax savings from an average solar installation can reach $7,500. The solar tax credit is a tax credit rather than a deduction, offering larger savings.

How to Qualify for the Federal Solar Tax Credit

Not all projects qualify for this credit. However, the following general guidelines can help determine eligibility:

- The project must be located in your U.S. home.

- You must own the system.

- The system must have been placed in service in 2017 or later.

Claiming the Solar Tax Credit

To claim the solar tax credit, you must complete IRS Form 5695, which covers residential energy projects. You’ll need to provide details about your tax situation and the cost of your energy project.

Solar Tax Credit and Other Incentives

You can claim the solar tax credit even if you receive other clean energy incentives. However, these additional incentives could reduce the overall cost of your system, resulting in a smaller tax credit.

State-Level Solar Incentives

State-level solar incentives vary widely. Therefore, it’s important to understand your state’s rules before making a decision. Generally, receiving a state tax break or rebate won’t affect your ability to get solar credits from the IRS.

Utility-Based Clean Energy Incentives

Utility-based incentives can also help save money. However, the IRS requires that the overall cost used to calculate your credit must consider any assistance received from a public utility, unless that incentive is counted as income for federal tax purposes.

Conclusion

The federal solar tax credit is a significant incentive for homeowners to invest in solar energy. By understanding the guidelines and claiming process, homeowners can maximize their savings and contribute to a cleaner environment.